Executive Summary

With Israel’s ongoing occupation of Palestine, and with the de-development of the Palestinian economy, many Palestinians believe that growth in information and communications technologies (ICTs) is a viable way towards achieving economic prosperity and national self-determination. Yet the power dynamics that shape this sector, namely, the Israeli state, the international donor community, the Palestinian Authority (PA), and expatriate Palestinian capitalists (EPCs), limit its capacity to develop and to effect sustainable economic change in Palestinians’ lives.

This brief describes the difficulties Palestinians in the PA-dominated West Bank – where most ICT initiatives are launched – face in developing a robust ICT sector due to Israel’s ongoing military and digital occupation. It also explores the ways in which the PA initiated and facilitated ICT development in Palestine through its collaboration with EPCs as a way to overcome Israel’s crippling restrictions, albeit with limitations. While a flourishing Palestinian ICT sector will ultimately not be achieved so long as Israel continues its military and digital occupation of Palestinians, this brief provides recommendations for how the PA can nonetheless consolidate past gains and enable strategic investments in productive capabilities.

In 2017, Palestine ranked 123rd out of 174 globally, and 14th out of 19 regionally, in the International Telecommunication Union’s ICT Development Index, far behind neighboring Lebanon (64th) and Jordan (70th). Any progress in the Palestinian ICT sector has largely occurred due to the telecommunications infrastructure put in place since the 1993 Oslo Accords. In 1997, the Palestine Telecommunications Company P.L.C. (PALTEL), now part of Paltel Group, was granted exclusive licenses of five and 10 years to build and operate telecommunications and mobile communications systems. Today, Paltel Group reaches over 98% of Palestinians living in areas A and B through its subsidiary mobile operator, Jawwal, compared to only 2% in 1997 when it began operations.

This success in deploying basic ICT infrastructure should, however, not overshadow the fact that Palestinians have been suffering from extremely low transmission rates, high latency, steep subscription prices, and outdated technology. Indeed, in 2021, cellular download and upload speeds reached an average of 7.7 Mbps and 2.2 Mbps, which means Palestine ranked third lowest in the Speedtest Global Index.

The underdevelopment of Palestinian ICT infrastructure, despite recent buildups, is a result of the Israeli ban on optical fiber for Palestinian households, as well as restricted cellular usage of 2G frequencies in Gaza and 3G in the West Bank. That is, Israel ensures newly-built Palestinian transmission lines to function merely as extensions of Israeli backbone networks, with the latter already spanning the West Bank to connect illegal Israeli settlements.

The Palestinian Ministry of Telecommunications and Information Technology (MTIT), which is responsible for regulating the market, cannot exercise the executive and legislative powers for which it was founded in 2008; it remains heavily underfunded, short on staff, and suffers from geographical division between Gaza and the West Bank. As a result, Palestinian firms are not receiving the necessary institutional support to build competitive organizational and marketing capabilities in order to succeed under international market pressure.

Despite its weak bargaining position against Israel, in the late 1990s, when the PA could neither enforce property rights nor provide the stability needed for private capital to flow into Palestine, PA officials answered a call from EPCs in the Gulf who pledged, at first, to play an active role in building Palestinian ICT infrastructure. At the heart of their agreement, EPCs were granted conditional access to exclusive monopoly rents in exchange for long-term investments in productive capability growth.

Unlike in classical patron-client networks, however, EPCs have no incentive to bypass the PA, and consequently engage directly with Israel in pursuit of higher rents. For Israel, collaboration with EPCs has guaranteed it influence and control over Palestinian telecommunications development. As a result, governmental ICT services are promoted in such a way that they pose no immediate threat to the mobility of large-scale rent flows, from which Israel benefits.

While the PA is limited in its capacity to consolidate and invest in productive ICT development, it should:

- Uphold political pressure against Israel to ease import restrictions, especially on 4G/5G technology.

- Create a platform through which stakeholders can communicate and align their efforts at ICT development. For this, the PA should commission independent market assessment studies to ensure evidence-based decision-making.

- Strengthen and renew education policies to foster knowledge related to ICT.

- Focus its development policies on institutionalizing funding distribution channels, so that investments in higher education facilities are more efficient and transparent. It should establish an agency that coordinates these financial flows.

Overview

For the past two decades, stakeholders in Palestinehave been ramping up efforts to promote the deployment and diffusion of new information and communications technologies (ICTs) to generate economic opportunities. As a broad concept, new ICTs refer to the use of digital processing and telecommunications— such as data networks, the Internet, computers, smart and mobile phones, satellites, and other wireless technologies — to collect, create, analyze, store, manipulate, and communicate information.1With Israel’s ongoing occupation of Palestine, and with the de-development of the Palestinian economy, many Palestinians are convinced that ICT-led growth is a viable way towards achieving economic prosperity and, in turn, towards achieving national self-determination. Yet the power dynamics that shape this sector, namely, the Israeli state, the international donor community, the Palestinian Authority (PA), and expatriate Palestinian capitalists (EPCs), limit its capacity to develop and to effect sustainable economic change in Palestinians’ lives. This brief describes the difficulties Palestinians face in developing a robust ICT sector due to Israel’s ongoing military and digital occupation. While it describes some of the challenges faced by Palestinians in Gaza, it primarily focuses on the PA-dominated West Bank, where most Palestinian ICT initiatives are launched. It also explores the ways in which the PA initiated and facilitated ICT development in Palestine through its collaboration with EPCs as a way to overcome Israel’s crippling restrictions, albeit with limitations. While a flourishing Palestinian ICT sector will ultimately not be achieved so long as Israel continues its military and digital occupation of Palestinians, this brief provides recommendations for how the PA can nonetheless consolidate past gains and enable strategic investments in productive capabilities.

Palestine’s Struggling ICT Sector

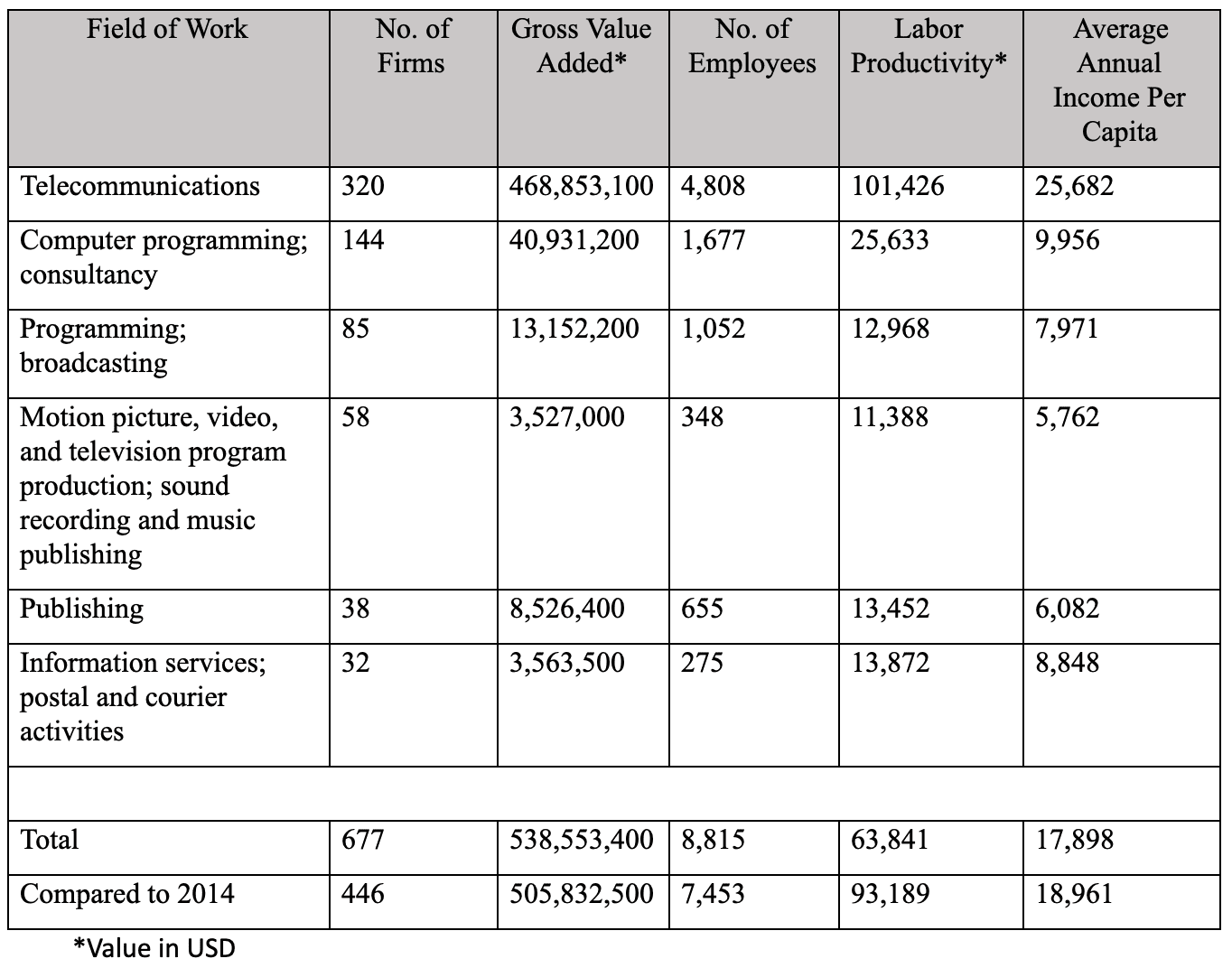

In 2017, Palestine ranked 123rd out of 174 globally, and 14th out of 19 regionally, in the International Telecommunication Union’s ICT Development Index, far behind neighboring Lebanon (64th) and Jordan (70th). In 2018, the Palestine Central Bureau of Statistics (PCBS) reported that the Palestinian ICT sector constituted 677 registered firms with 8,815 employees, which amounts to less than 1% of the workforce and 4% of nominal GDP, while also having accumulated a trade deficit of $200 million in 2017.Israel ensures newly-built Palestinian transmission lines to function merely as extensions of Israeli backbone networks (which) connect illegal Israeli settlements Share on XProgress in the Palestinian ICT sector has largely occurred due to the telecommunications infrastructure put in place since the 1993 Oslo Accords. In 1997, the Palestine Telecommunications Company P.L.C. (PALTEL), now part of Paltel Group, was granted exclusive licenses of five and 10 years to build and operate telecommunications and mobile communications systems, which persisted until competitor Ooredoo Palestine (formerly known as Wataniya) entered the cellular market in 2009. Today, Paltel Group reaches over 98% of Palestinians living in areas A and B through its subsidiary mobile operator, Jawwal, compared to only 2% in 1997 when it began operations. The key driver has been the cellular phone, with over four million active subscriptions in 2020, an increase of 66% compared to 2010. Together with Ooredoo Palestine and other contract vendors, Paltel Group makes up 87% of the total value of the ICT industry, and it employs 55% of the industry’s workforce (see table 1). Paltel Group, according to the company, represents Palestine’s most profitable firm and largest private sector employer, with at least 3,000 employees on its payroll. It accounts for not less than 20.5% of the Palestinian stock market, and it realized a market capitalization of $705 million in 2020, the highest of all publicly-traded companies in Palestine.

This success in deploying basic ICT infrastructure should, however, not overshadow the fact that Palestinians have been suffering from extremely low transmission rates, high latency, steep subscription prices, and outdated technology. Indeed, in 2021, cellular download and upload speeds reached an average of 7.7 Mbps and 2.2 Mbps, respectively, ranking third lowest in the Speedtest Global Index. In Jordan, for comparison, mobile internet achieves speeds of 25.1 Mbps and 17.3 Mbps respectively.

Fixed broadband performance in Palestine ranked 130st globally in 2021, with average download and upload speeds of 22 Mbps and 10.4 Mbps, respectively. In 2018, 40% of subscribers were reliant on a download speed of 8 Mbps or less. Due to stiff prices and low quality, fixed broadband penetration rates stood at 6.9% in 2019, while another 69% of connected households in the West Bank and 12% in Gaza relied alternatively on mobile networks.

The underdevelopment of Palestinian ICT infrastructure, despite recent buildups, is a result of the Israeli ban on optical fiber for Palestinian households, as well as restricted cellular usage of 2G frequencies in Gaza and 3G in the West Bank. First reports indicating the possible rollout of 4G in Palestine surfaced on August 31, 2021; however, the installation process will take up to one year, and Palestinians will continue to lag behind Israel, which offers 5G frequencies.

To be sure, meaningful progress in the deployment and diffusion of Palestinian ICTs is dependent on, and determined by, Israel. As an occupying power, the Israeli government continues to exercise full control over Palestine’s electromagnetic field, despite having officially recognized the right of the Palestinian people to independent communications systems in Article 36 of Annex III of the Oslo Accords in 1995.

On the ground, this means that Israel ensures newly-built Palestinian transmission lines to function merely as extensions of Israeli backbone networks, with the latter already spanning the West Bank to connect illegal Israeli settlements. Landline calls taken from or within occupied Palestine, for example, run via Israel, while Palestinians neither possess an independent internet trunk switch, nor an independent international telecommunications gateway.

Israel has been claiming security concerns as the reason for prohibiting Palestinian traders from importing advanced equipment for commercial usage. Simultaneously, it has ensured that Palestinians can only purchase hardware technology from Israeli suppliers. Indeed, Israel’s Ministry of Communication (IMC) regulates market conditions for Paltel Group and Ooredoo Palestine, and these Palestinian firms must apply for access to higher bandwidths and cellular wavelengths from the IMC.

The World Bank estimates that, as a direct result of these restrictions, the Palestinian cellular market alone suffered from revenue losses anywhere between $436 to $1,150 million from 2013 to 2015. Additionally, Israeli telecommunications and former state-owned company, Bezeq, charges Hadara, an internet service provider owned by Paltel Group, connection and termination fees for using its backbone networks, while Jawwal and Ooredoo Palestine are made to purchase limited frequencies from their Israeli counterparts via the Palestinian Ministry of Telecommunications and Information Technology (MTIT), once approved by the IMC.

Both Jawwal and Ooredoo Palestine suffer from crippling competition by Israeli operators, which captured at least 20% of market share in 2020 precisely because they can offer cheaper packages with higher speed thanks to illegal transmission towers across the West Bank. What is more, at least 40% of Palestinians holding Israeli work permits are paying for Israeli subscriptions to ensure uninterrupted connectivity during their daily commutes.

The MTIT, which is responsible for regulating the market, cannot exercise the executive and legislative powers for which it was founded in 2008; it remains heavily underfunded, short on staff, and suffers from geographical division between the de facto Hamas government in Gaza and the Fatah-held government in the West Bank. As a result, and unlike their regional competitors, Palestinian firms are not receiving the necessary institutional support to build competitive organizational and marketing capabilities in order to succeed under international market pressure.

When it comes to innovation, the political status quo discourages Palestinian policymakers from initiating research and development programs that would help integrate Palestinian ICT capabilities into digital value chains. Ultimately, this would be crucial for shifting innovation away from local needs to global transformation processes. Universities have also been unable to prepare their graduates in ICT-related fields since they lack the financial resources and teaching techniques to equip students with the skill sets for which companies are scouting. These fields include engineering, coding, and telecommunications, among others.

Indeed, unemployment among these graduates — who numbered 2,545 in 2021 (merely 4% of total graduates across Palestine) — stood at around 30% nationwide in 2020. And within Palestine, successful start-ups have only been able to build on existing business models by replicating those for the Arab-speaking world, after which Palestinian firms had to seek either partners abroad to ensure legal insurances for their operations, or they simply sold their products altogether.

Collaborating with EPCs to Mitigate Israel’s Occupation

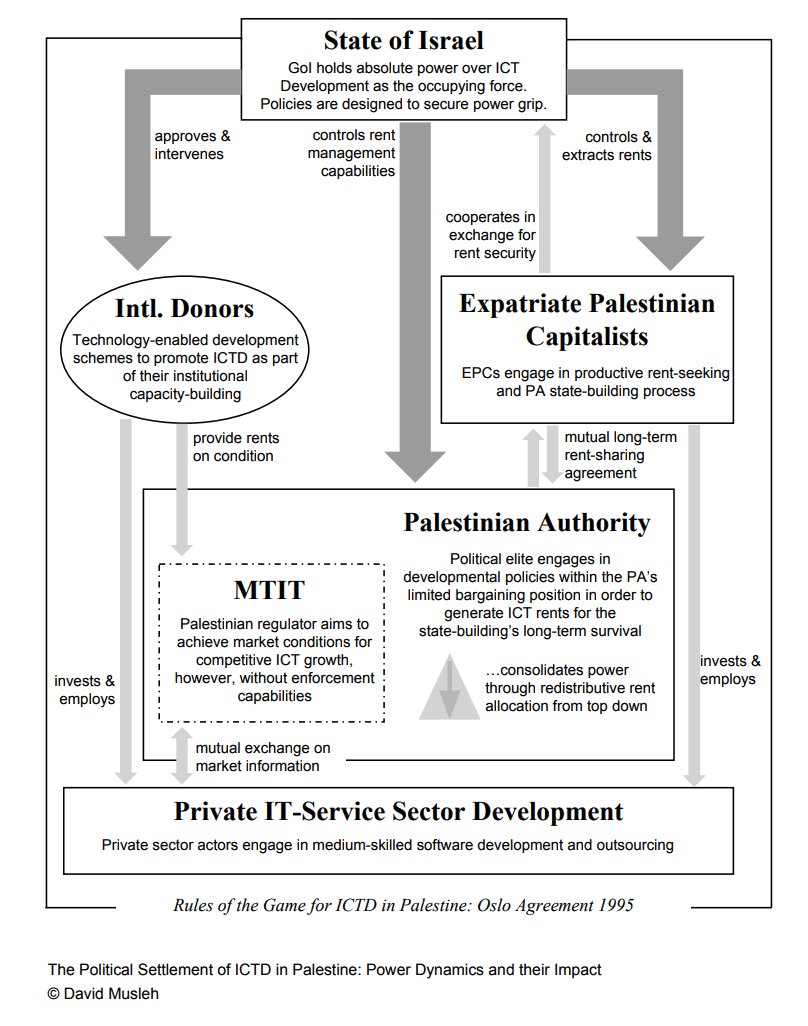

Despite the PA’s weak bargaining position against Israel, it has been following a development strategy for the past two decades to build a Palestinian ICT industry by initiating productive growth and expanding its rent-management capabilities. The latter is of particular importance for the PA’s ability to alter power dynamics in favor of greater economic freedom. This is because additional rent income allows Palestinian leadership crucial leeway to not only protect its political monopoly by fueling its own informal financial distribution channels, but also to implement its strategy (see figure 1 below).

At least 40% of Palestinians holding Israeli work permits are paying for Israeli subscriptions to ensure uninterrupted connectivity during their daily commutes Share on X

The PA actively pushed for the creation of a national capitalist class which would build a market-based ICT industry. But in the late 1990s, when the PA could neither enforce property rights nor provide the stability needed for private capital to flow into Palestine, PA officials answered a call from Palestinians in the Gulf who pledged, at first, to play an active role in building Palestinian ICT infrastructure. At the heart of their agreement, EPCs — who then went on to establish PALTEL — were granted conditional access to exclusive monopoly rents (i.e. licenses) in exchange for long-term investments in productive capability growth. This included enhancing technological learning processes and creating meaningful employment opportunities.

Monopolization of the telecommunications segment was, from a development perspective, inevitable given the Palestinian economy’s small size and the stiff competition from Israeli firms. Conditionality, though, is key: in the absence of strong, formal institutions that can enforce the law, the elite within the PA built their institutions so that rent management capabilities would be concentrated at the very top. This way, policymakers ensured that these capitalists did not defect from their role as junior partners, for instance, by forging alternative alliances to seek higher but dysfunctional rents.In order for the PA to expand its institutional capabilities, which include both formal and informal institutions, it has claimed a fraction of these telecommunications rents. The PA owns minority shares in both Paltel Group (6.7%) and Ooredoo Palestine (34.7%) through the PA-affiliated Palestine Investment Fund. It also receives a 7% share in the annual revenue of Paltel Group as part of their initial rent-sharing agreement from 1997, which, together with income tax and VAT, adds around $15.5 million in monthly revenue to the PA budget. A more striking example of the PA’s continuous ability to discipline its junior partners is that Paltel Group agreed to pay, beyond existing commitments, $290 million for a 20-year extension of the company’s cellular and fixed line licenses during their latest round of negotiations in 2016. Moreover, the PA benefits indirectly from EPCs’ investments, which have created employment opportunities that ultimately reduce dependency on the public sector. EPCs are thus indispensable to the political elite in Palestine, precisely because they hold the organizational and developmental capabilities to translate policy goals into economic realities. That is, their rent-sharing agreement with the PA promises high profit margins for investments in productive telecommunications capacity-building. Unlike in classical patron-client networks, however, EPCs have no incentive to bypass the PA, and consequently engage directly with Israel in pursuit of higher, and therefore distortive, rents. This is because EPCs are not simply rent-seekers; manyalso have political ambitions for Palestine. First and foremost, they are committed to the survival and success of the Palestinian national movement, which ensures that the PA and its arrangements persist.EPCs have sought to avoid public scrutiny for encouraging and engaging in collaboration with Israel, something that has kept their alliances mostly informal (see figure 1 above). However, this has hurt the functioning of the MTIT, as it allows EPCs to bring forward their business-related queries to Israel directly, negatively impacting the role of the MTIT as the central and sole communication point for both parties. For Israel, collaboration with EPCs has guaranteed it influence and control over Palestinian telecommunications development.

Israel has full control over the creation and distribution of Palestinian technology dividends, and it ensures the hegemony of its communications networks, including its surveillance systems. This has far-reaching implications for Palestinian ICT development. As the PA remains unwilling to shape regulatory framework conditions, it has not sought to strengthen the MTIT, which ultimately serves to implement IMC policies under the current political settlement. This reality has also meant that the PA has failed to promote entrepreneurial policies; it has thus only been able to achieve short- to medium-term progress in telecommunications development in order to earn higher rents. It is also unsurprising that the PA is hesitant to answer calls from the international donor community, or from domestic civil society organizations such as corruption watchdog AMAN, to advance the implementation of e-Government services or data protection that enforce transparency. Indeed, this would further constrain the PA’s ability to manage rents freely, and thus, uphold the rent-sharing agreement. As a result, governmental ICT services are promoted in such a way that they pose no immediate threat to the mobility of large-scale rent flows.Nevertheless, the PA has managed to make some progress. A crucial indicator for the effectiveness of its rent-sharing agreement is that monopoly rents, to some extent, remain in Palestine. Paltel Group and Ooredoo Palestine have also created productive jobs in telecommunications with roughly 4,500 employees earning higher salaries than in any other sector, including the public sector. This has eased pressure on the PA to create job opportunities for a struggling working class. In addition to investing in infrastructure, it has also required EPCs to increasingly allocate profits into innovation capacities, including IT education and funding and mentoring of entrepreneurship. Expatriate Palestinian capitalists have sought to avoid public scrutiny for encouraging and engaging in collaboration with Israel Share on XFor this, Paltel Group, and to a lesser extent Ooredoo Palestine, have been engaged in reshaping entrepreneurial promotion schemes, a field that has been served nearly exclusively by international donor capital. That is, on the one hand, donors and EPCs currently compete over influence in the ICT service sector, and on the other, they collaborate when mutually beneficial. Paltel Group, for instance, launched business incubator Fikra in 2018, supporting entrepreneurs in developing online applications by providing access to mentoring, Jawwal’s in-house ICT systems, and equity-based funding for high-potential start-ups. The extent to which interactions between donors and EPCs advance ICT development will ultimately hinge on Israel’s continued occupation, but also upon their ability and willingness to align their strategies (see figure 1 above).The Palestinian political elite, particularly in the absence of government-led funding, have legitimate interests in the EPCs’ quest to establish a national innovation system, as it would reduce donor interference in crucial economic decision-making processes. While in the medium term these investors may be rewarded — since they claim their share in innovation rents — both the PA and private sector stakeholders would benefit greatly in the long-term. From a policy perspective, a home-controlled innovation system offers greater scope to implement strategies that tackle pressing issues, such as unfavorable working conditions for entrepreneurs and freelancers, and allows for growth along market parameters.

Recommendations

An examination of two decades of the PA’s investment in ICT development provides valuable lessons for how it should enhance the role of ICT within the Palestinian economy, despite Israel’s continued occupation. And while EPCs play an important role in Palestine’s ICT development, they are junior partners. It is the PA, albeit a quasi government limited in its capacity to consolidate and invest in productive capabilities, that has been leading the developmental strategy. Accordingly, it should:

- Uphold political pressure against Israel to ease import restrictions, especially on 4G/5G technology. As the PA is unable to influence IMC regulations, it is important to bring forward the matter to relevant domestic and international stakeholders who can put political and economic pressure on Israel.

- Create a platform through which stakeholders can communicate and align their efforts at ICT development. This would allow them to set a clear path for future specialization in potential digital value chains. For this, the PA should commission independent market assessment studies to ensure evidence-based decision-making.

- Strengthen and renew education policies to foster knowledge related to ICT. Both EPCs and the international donor community are keen on investing in ICT education, given that their long-term success in generating rents will depend on higher ICT knowledge diffusion. The PA should seize upon this opportunity.

- Focus its development policies on institutionalizing funding distribution channels, so that investments in higher education facilities are more efficient and transparent. It should establish an agency that coordinates these financial flows.

- Strengthen relations with regional and global partners, such as Jordan and Tunisia, as well as Nigeria, Kenya, and South Africa, to improve knowledge exchange and ICT service exports. Stronger relations with regional and global governments would give the PA valuable experience in the development of ICT capabilities, particularly with regard to effective and inexpensive education policies, and innovative ways to overcome marketing deficits.

- To read this piece in French please click here. Al-Shabaka is grateful for the efforts by human rights advocates to translate its pieces, but is not responsible for any change in meaning.