Executive Summary

Israel is marshaling pro-Israel forces in Europe as well as in the US against the European Union’s recently issued guidelines on labeling some of its settlement products, for fear that this will lead to stronger measures. Samia al-Botmeh and Leila Farsakh debunk Israel’s arguments both as regards the impact on the Palestinian economy as well as on Palestinian workers.

Key Points

- Israel’s illegal settlement enterprise has clearly had a profoundly negative effect on the Palestinian economy, including the agricultural sector, extraction and manufacture of products from minerals, and the environment.

- The EU’s guidelines regarding labeling are insufficient to fulfill its legal obligations because they cover only some settlement products, are easy to circumvent, and delegate primary responsibility for enforcement to the member states.

- While Palestinian workers in the settlements are subject to difficult and sometimes dangerous working conditions, less than 2% of the total employed Palestinian population would be impacted in the event of closure of Israeli industries in the settlements.

- The EU should enforce a complete ban on all direct and indirect economic, financial, business, and investment activities with the Israeli settlements and halt financial relations with Israeli banks.

Background

In 2010, the European Court of Justice confirmed that products originating in the West Bank did not qualify for preferential customs treatment under the agreement. However, it was only in 2015 that the European Parliament took the long overdue step of aligning its actions with its own regulations when it passed a resolution calling for the labeling of goods produced in the Israeli settlements. Israel argued that the EU move was “discriminatory” and that it was harmful to Palestinian workers. However, the fact that Israel’s settlement construction has been based on the economic exploitation of the OPT has been widely documented.

The Settlements’ Economic Exploitation of the OPT

Israeli settlements control 85.2% of the most fertile land in the West Bank. Israeli revenue from the exploitation of Palestinian land and resources in the Jordan Valley and northern Dead Sea is estimated at around NIS 500 million annually (around $130 million). Meanwhile, Palestinians are prevented from living there, building, or even herding their livestock.

A Palestinian Economy Stifled by Settlements

Restricted access to and production in Area C has cost the Palestinian economy an estimated $3.4 billion. Israel’s control over water and land has decreased the labor productivity of the agricultural sector and its contribution to GDP. The dumping of solid waste and wastewater from industrial zones in the settlements into the OPT has further polluted the Palestinian environment.

Restricted access to the vast resources of the Dead Sea has prevented Palestinians from establishing cosmetics businesses and other industries, based on the extraction of minerals. The production and sales of magnesium, potash, and bromine would otherwise have had an estimated annual value added of $918 million, the equivalent of 9% of GDP in 2011.

Dispossessed: Palestinian Workers in Israeli Settlements

This harsh economic reality is the primary factor driving some Palestinians to work in Israeli settlements, mostly in low skilled, low paying jobs. However, less than 2% of the total employed Palestinian population would be impacted in the event of closure of Israeli industries in the settlements.

Palestinian workers in the settlements are subject to difficult and sometimes dangerous working conditions and are paid, on average, less than half the Israeli minimum wage. They are subject to arbitrary dismissal and withholding of their permits if they demand their rights or try to unionize.

The Gap Between EU Rhetoric and Action

In light of these facts, the guidelines regarding labeling are insufficient to fulfill the EU’s legal obligations to not recognize as lawful an illegal situation. Not all products from Israeli settlements are to be labeled. In addition, Israeli companies operating in the settlements can easily circumvent the labeling of their products by mixing goods or using alternative office addresses. Meanwhile the labeling guidelines themselves seem toothless since enforcement is, for the most part, left to member states.

Furthermore, in clear divergence from its rhetoric, the EU undertakes projects with Israeli companies that are deeply involved in the settlements and the occupation. European banks are also connected to Israeli banks, which provide mortgages for settlers, finance Israeli authorities in the settlements, and fund state-sponsored construction of settlements.

How the EU Can Better Uphold the Law

The EU should follow in the footsteps of Copenhagen, Reykjavik, and recently Amsterdam by enforcing a complete ban on all direct and indirect economic, financial, business, and investment activities with the Israeli settlements. It should also halt financial relations with Israeli banks, and EU member states should on their own halt all relations with Israeli settlements. The EU is Israel’s largest trading partner, and a serious EU move would have real impact on Israel’s settlement enterprise.

Finally, just banning Israel’s settlement products would exert much less pressure on Israel to end its occupation than banning the very system that is masterminding the colonization of the territories. For Palestine, such a boycott would help protect Palestinian goods, increase their competitiveness, and help to ensure the ability of the Palestinian economy to be integrated into the international economy in the future, once freedom is assured.

Overview

Israel sees the European Union’s recently issued guidelines on labeling some of its settlement products as the thin edge of the wedge. It fears this will open the door to stronger measures against its illegal settlement enterprise and is marshaling pro-Israel forces in Europe as well as in the United States. One of its oft-repeated arguments is that labeling harms Palestinian workers.1

In this policy brief, Policy Advisors Samia al-Botmeh and Leila Farsakh debunk Israel’s arguments by demonstrating the devastating impact Israel’s settlement enterprise has had on the Palestinian economy, dispossessing Palestinians of their land, water, and other resources and creating mass unemployment. They also address the status of those Palestinian workers – a minority of the work force – that have been forced to earn a living in the very settlements that have done so much damage to the Palestinian economy and to Palestinian rights more broadly. They go on to examine the European Union (EU) move and recommend additional steps the EU should take to be fully compliant with international and European law.2

Background

It has taken years for the EU to develop its position on the labeling of goods produced in the settlements Israel has built in Palestinian and Syrian territory since occupying it in 1967. The European Commission issued a statement in 1998 that Israel was suspected of a breach of the EU-Israel Association Agreement, which was signed in 1995 and came into effect in 2000, and which exempted Israeli goods from customs duties. In 2010, the European Court of Justice confirmed that products originating in the West Bank did not qualify for preferential customs treatment under the EU’s Association Agreement with Israel, and that assertions by Israeli authorities were not binding upon EU customs authorities.

However, it was only in 2015 that the EU took the long overdue step of aligning its actions with its own regulations, partly in response to growing civil society pressure to recognize the illegality of settlements. On September 10, the European Parliament passed a resolution calling for the labeling of goods produced in the Israeli settlements as produced in “Israeli settlements” rather than in “Israel” and ensuring that they would not benefit from preferential trade treatment under the EU-Israel Association Agreement. Two months later, on November 11, the EU issued its long-awaited guidelines regarding labeling, which it described in low-key language as an “Interpretative Notice.” However, settlement products will still be traded with the European Union (EU), leaving it to consumers to make an “informed decision” as to whether to buy these products or not.

Israel claims that the EU move is “discriminatory” and that it is harmful to the Palestinian economy in general and to Palestinian workers in particular. This is clearly an attempt by Israel to divert international attention from the reality of the illegal settlement enterprise, its profoundly negative effects on the Palestinian economy, and the moral and legal obligations of the EU. In fact, Israel’s entire settlement enterprise is illegal under international law, as reaffirmed by the International Court of Justice in its Advisory Opinion on Israel’s Separation Wall in 2004. Israel’s transfer of its population to the occupied territory is a breach of the Hague Regulations of 1907 and the Fourth Geneva Convention of 1949.

The Settlements’ Economic Exploitation of the OPT

This policy brief focuses on the territories Israel occupied in 1967 – the West Bank, including East Jerusalem, the Gaza Strip, and the Golan Heights – and more specifically on the Israeli settlements and outposts that were built in the occupied Palestinian territory (OPT).3 It does not tackle all of Israel’s violations of international law and of Palestinian rights.

The fact that Israel’s settlement construction has been based on the economic exploitation of the OPT has been widely documented. This has included the confiscation of large swathes of Palestinian land and destruction of Palestinian property to use for construction and agriculture purposes; seizure of water resources to the extent that 599,901 settlers use six times more water than the whole Palestinian population in the West Bank of some 2.86 million; appropriation of touristic and archeological sites; and exploitation of Palestinian quarries, mines, Dead Sea resources, and other non-renewable natural resources, as will be discussed below.

Settlements have also been supported by an infrastructure of roads, checkpoints, and the Separation Wall, leading to the creation of isolated Bantustans in the West Bank, and to the appropriation of more Palestinian land.

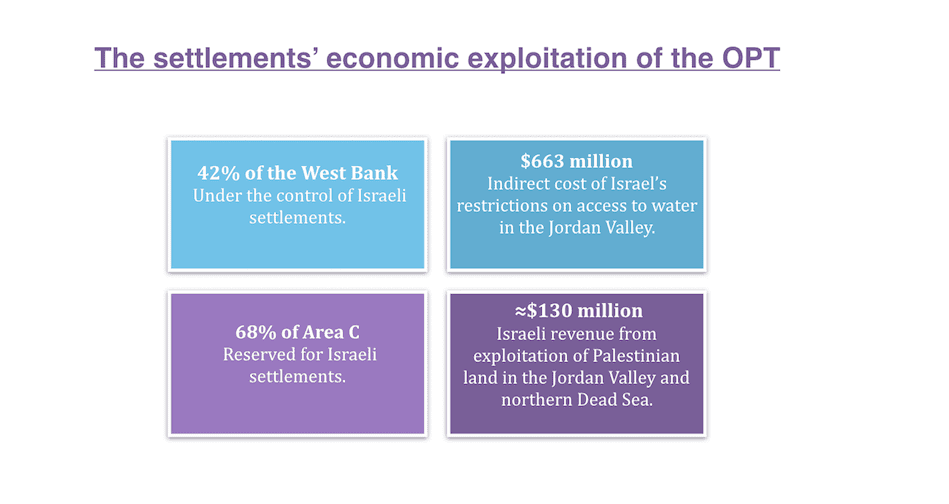

As a result, Israeli settlements now control around 42% of West Bank land. This figure includes built-up areas as well as the municipal boundaries of the Israeli settlements. These boundaries actually encompass an area 9.4 times larger than the built-up areas of the West Bank settlements and are off-limits to Palestinians unless they have permits.

The majority of settlements in the West Bank are built in Area C, which represents 60% of the West Bank and which is richly endowed with natural resources.4 According to a World Bank study, 68% of Area C has been reserved for Israeli settlements, while less than 1% has been allowed for Palestinian use.

Within Area C, Israeli settlement exploitation is concentrated in the Jordan Valley and the northern part of the Dead Sea. Israeli settlements control 85.2% of these areas, which are the most fertile land in the West Bank. Their abundant water supply and favorable climate provide the best conditions for agriculture. Indeed, they yield 40% of date exports from Israel. Meanwhile, Palestinians are prevented from living there, building, or even herding their livestock under the pretext that the land is either “state land,” “a military zone” or a “natural reserve.”

Israel also resorts to other ways to expel Palestinians from their lands, by demolishing houses, prohibiting the building of schools and hospitals, and denying residents access to essential services like electricity, water, and well digging. By contrast, most settlements are designated as “national priority areas,” allowing them to receive financial incentives from the Israeli government in the area of education, health, housing construction, and industrial and agricultural development.5

Israeli revenue from the exploitation of Palestinian land and resources in the Jordan Valley and northern Dead Sea is estimated at around NIS 500 million annually (around $130 million). To get a sense of the impact on the Palestinian economy, it is worth noting that the indirect cost of Israel’s restriction on Palestinian access to water in the Jordan Valley – and their inability to cultivate their land as a result – was $663 million, the equivalent of 8.2% of Palestinian GDP in 2010 (see Table E1 in this report).

Meanwhile, Israel continues to build new settlements. Netanyahu claimed during his speech at the US Center for American Progress, in November, that no new settlements have been built in the past 20 years. In fact, 20 Israeli settlements were approved under his rule, three of which were illegal outposts that were then approved by the government.

The most recent manifestation of Israeli settlement policy is the renewed construction of the Separation Wall near Beit Jala in the West Bank, effectively separating the villagers from their privately owned farmland in the Cremisan Valley. The route of this segment of the Wall is designed to allow for the annexation of the settlement of Har Gilo south of Jerusalem, giving it contiguity with the Gilo settlement situated within the boundaries Israel created for the Jerusalem municipality after its occupation began in 1967.

A Palestinian Economy Stifled by Settlements

Israel’s illegal settlement enterprise has clearly had a profoundly negative effect on the Palestinian economy. Israel’s control over water and land has helped to decrease the labor productivity of the agricultural sector and its contribution to GDP: The contribution of agriculture, forestry and fishing declined from 13.3% in 1994 to 4.7% in 2012, at current prices. The dumping of solid waste and wastewater from industrial zones in the settlements into the OPT has further polluted the Palestinian environment, land, and water.

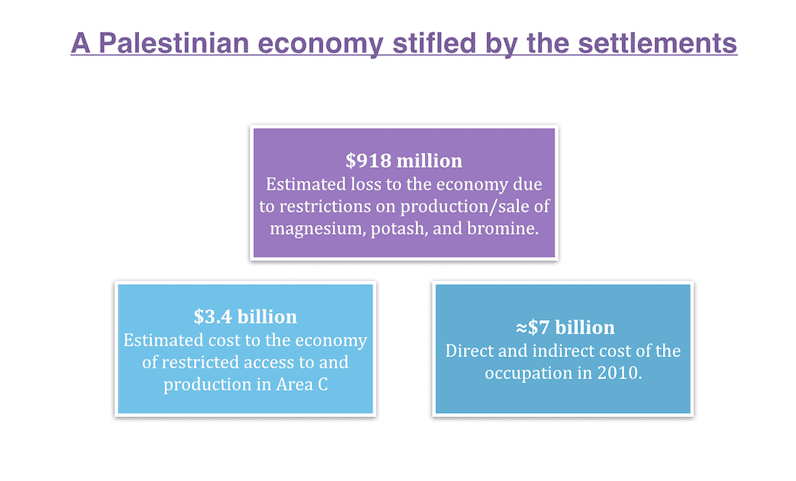

Restricted access to the vast resources of the Dead Sea has prevented Palestinians from establishing cosmetics businesses and other industries, based on the extraction of minerals. A World Bank study estimated that had there not been access restrictions, the production and sales of magnesium, potash, and bromine would have had an annual value added of $918 million to the Palestinian economy, the equivalent of 9% GDP in 2011.

Severe constraints on access to mines and quarries in Area C have also hindered Palestinians’ ability to extract gravel and stones. The estimated annual lost gross value added to the Palestinian economy from quarrying and mining is $575 million. In total, it is estimated that restricted access to and production in Area C has cost the Palestinian economy $3.4 billion. As discussed in an earlier Al-Shabaka policy brief, Israel even controls Palestinian access to their own electro-magnetic sphere – a policy to which the settlements contribute – creating losses of between $80 to $100 million annually for Palestinian telecommunication operators.

Furthermore, the absence of contiguity within the West Bank, coupled with other Israeli movement and access restrictions, has fragmented the West Bank economy into smaller disconnected markets. This has increased the time and costs to transport goods from one area in the West Bank to another, and from the West Bank to the rest of the world. As a result, the competitiveness of Palestinian goods in local and export markets has weakened.

Moreover, as the economy in the West Bank has been marred by unpredictability and uncertainty – which is not surprising, given that the area is under military occupation – the cost and risks of doing business have risen. This has worsened the investment climate, constrained economic development, and increased unemployment and poverty. Overall, it is estimated that the direct and indirect cost of the occupation was almost $7 billion in 2010 − almost 85% of the total estimated Palestinian GDP.6

Dispossessed: Palestinian Workers in Israeli Settlements

The Palestinian economy has thus been suffering from structural and sectoral weaknesses that are primarily due to Israel’s occupation and its settlement enterprise. The settlements’ take-over of land, water, and natural resources and Israel’s restrictive control of movement, access, and other freedoms have debilitated the economy’s productive base, which is no longer able to generate enough employment and investment, and is increasingly dependent on the Israeli economy and foreign aid.

This harsh economic reality is the primary factor driving some Palestinians to work in Israeli settlements – the figure is estimated at just 3.2% of the total employed persons from the West Bank in the Third Quarter of 2015.7 Instead of being self-sufficient owners of means of production Palestinians have been dispossessed of their economic resources and rights by the Israeli military occupation and Israel’s settlements, and have been transformed into cheap labor.

In fact, most Palestinian workers in the settlements are in low skilled, low paying jobs: At least half of them are employed in the construction sector. In other words, less than 11,000 Palestinians are employed in Israeli settlement industry and/or agriculture. This means that less than 2% of the total employed Palestinian population would be impacted in the event of closure of Israeli industries in the settlements.

Palestinian workers in the settlements are subject to difficult and sometimes dangerous working conditions, and it is estimated that 93% do not have labor unions to represent them. Indeed, they are subject to arbitrary dismissal and withholding of their permits if they demand their rights or try to unionize. A 2011 survey found that the majority of Palestinian workers would leave their jobs in the settlements if they could find an alternative in the Palestinian labor market.

While it is argued that Palestinian workers in settlements receive higher wages than in the Palestinian labor market, it is worth noting that they are paid, on average, less than half the Israeli minimum wage. For example, in Beqa’ot, an Israeli colony in the Jordan Valley, Palestinians are paid 35% of the legal minimum wage. Note that the packing houses of Mehadrin, the largest Israeli exporter of fruits and vegetables to the EU, are located in this settlement.

In short, it is effectively Israel’s settler-colonial enterprise that hurts Palestinians, much more than the EU labeling of settlements products. What Palestinians need is not more jobs in settlements or more dependency on the Israeli economy. Rather, what Palestinians need is the dismantling of Israeli settlements, an end to the occupation, and the full realization of their rights under international law. Only then can they truly strengthen the productive base of the Palestinian economy, generate employment opportunities, ensure self-reliance and self-sufficiency, and stop being dependent on foreign aid.

The Gap Between EU Rhetoric and Action

It is against this background that the EU’s role vis-à-vis Israeli settlements should be discussed. The EU recognizes that Israeli settlements established in the OPT are illegal. Its Interpretative Notice clearly stated that the EU, “in line with international law, does not recognise Israel’s sovereignty over the territories occupied by Israel since June 1967.” And yet the EU imports goods from the Israeli settlements (mostly fresh fruits and vegetables that are grown in the Jordan Valley) at an estimated annual value of $300 million. This is more than 17 times the average annual value of goods exported from the OPT to the EU between 2004 and 2014.

Despite the Interpretative Notice, there remains a large discrepancy between the EU’s rhetoric and its actions, and the Notice is insufficient to fulfill the EU’s legal obligations, for several reasons. To begin with, not all products from Israeli settlements are to be labeled. Only fresh fruits and vegetables, poultry, olive oil, honey, oil, eggs, wine, cosmetics, and organic produce are subject to mandatory indication of origin. Pre-packaged foods and industrial goods that are not cosmetics are only subject to voluntary indication of origin.

In addition, Israeli companies operating in the settlements can easily circumvent the labeling of their products. For example, they can mix goods produced in the settlements with other goods produced in Israel and avoid their being labeled as “settlement products.” They can use the address of an office inside Israel’s internationally recognized borders as the company’s official address instead of the actual site of production. The EU should also note that those companies that do label their products as produced in the settlements can receive compensation from the Israeli government for any losses they might incur. It is estimated that the state budget has allocated some $2 million each year for the past 10 years to compensate Israeli companies in the settlements for losses they would face as a result of the halt of preferential customs treatment and other benefits.

Meanwhile the labeling guidelines themselves seem toothless since “enforcement of the relevant rules remains the primary responsibility of Member States,” as the EU Interpretative Notice stated. More importantly, by only labeling produce from the settlements, while maintaining trade and investment relations with them, the EU is actually continuing to finance the expansion of the settlements and perpetuating Israel’s occupation, exploitation of Palestinian natural resources, and appropriation of Palestinian land – an illegal situation the EU claims not to “recognize.”

Furthermore, in clear divergence from its rhetoric, the EU undertakes projects with Israeli companies that are deeply involved in the settlements and the occupation. For instance, the EU has approved 205 projects with Israeli participation in Horizon 2020, the largest EU research and innovation program. The participating Israeli companies include Elbit, which is directly involved in the construction of settlements and the Wall; Israel Aerospace Industries, which supplies the equipment needed for the construction of the Wall; and Technion University, which works with the Israeli military complex. European banks are also connected to Israeli banks, which provide mortgages for settlers, finance Israeli authorities in the settlements, and fund state-sponsored construction of settlements and other business activities that perpetuate the settlement enterprise.

Therefore, the EU’s Interpretative Notice seems to be primarily a symbolic step, through which it pays lip service to the growing demands from European civil society, which is increasingly supportive of the Palestinian-led Boycott, Divestment and Sanctions (BDS) movement, that it apply its regulations and hold Israel accountable. Under international law third states are obliged not to recognize as lawful an illegal situation, not to provide any assistance to maintain an illegal situation, and to cooperate to ensure the compliance by Israel with international humanitarian law. In other words, the EU and its member states should do everything possible to put an end to Israel’s illegal settlement enterprise.

How the EU Can Better Uphold the Law

The EU could begin to translate its rhetoric into effective measures to hold Israel accountable by enforcing a complete ban on all direct and indirect economic, financial, business, and investment activities with the Israeli settlements, following in the footsteps of Copenhagen, Reykjavik, and recently Amsterdam. As recently recommended in a European Council on Foreign Relations report, it should also halt financial relations with Israeli banks, especially those that finance the occupation and the construction of settlements. In addition, the EU member states should on their own cease all relations with Israeli settlements.

It is worth noting here that the EU is Israel’s largest trading partner, with trade totaling around 30 billion Euros in 2014 (around $36 billion using Dec 31, 2014 exchange rates), which represents around 33% of the total Israeli exports of goods and services in 2014.8 EU trade with Israeli settlements represents less than 1% of EU trade with Israel. A serious EU move would have real impact on Israel’s settlement enterprise and prolonged military occupation.

In addition to moving from labeling settlement products to ending all dealings with Israeli settlements, European countries should consider a ban on all Israeli goods. Since the EU recognizes that Israel’s control of the OPT is a state of occupation – a nearly 50-year military occupation – it should deal with the root cause of the occupation, i.e. Israeli government policy, rather than just the symptom of the occupation, i.e. the settlements.

In apartheid South Africa, for example, a boycott that only focused on businesses that bordered townships would not have greatly affected the apartheid system. Similarly, just boycotting Israel’s settlement products would have much less impact than boycotting the very system that is masterminding the colonization of the territories in order to pressure Israel to end its occupation. This is why it is important to ban all Israeli goods and not only these of the settlements. Such a step would, among other things, address the issue of Israel’s cheating with regards to the origin of the goods and commodities from the settlements. This is difficult to control unless the actual companies are boycotted and not only their goods and services. In fact many of the companies working in the settlements originate in Israel rather than the 1967 territories.

The calls for a full boycott are growing and finding adherents in unlikely places. For example, two US academics recently argued in a Washington Post op-ed that just boycotting settlement goods would “not have sufficient impact.” Instead they called for “a withdrawal of U.S. aid and diplomatic support, and boycotts and divestitures from the Israeli economy” in order to reshape Israel’s strategic calculations.

For Palestine, such a ban would help protect Palestinian goods, increase their competitiveness, and help to ensure the ability of the Palestinian economy to be integrated into the international economy in the future, once freedom is assured. Boycotting all Israeli goods and services would be an effective way to empower the Palestinians to overcome Israeli colonialism. This would be much more effective than providing development assistance for specific sectors, and would directly respond to the demand of the Palestinian people for freedom and human rights.

- Al-Shabaka publishes all its content in both English and Arabic (see Arabic text here.) To read this piece in French, please click here. Al-Shabaka is grateful for the efforts by human rights advocates to translate its pieces into French, but is not responsible for any change in meaning.

- The authors thank the Heinrich-Böll-Foundation’s Palestine/Jordan Office for their partnership and collaboration with Al-Shabaka in Palestine. The views expressed in this policy brief are those of the authors and do not necessarily reflect the opinion of the Heinrich-Böll-Foundation.

- Settlement outposts are constructed without official authorization from the Israeli government. However, they receive financial support from ministries, government agencies, and local and international (mainly US) foundations and individuals. Israel often “legalizes” them after some time.

- Under the Oslo accords, the West Bank was for an interim period divided into Area A, which is supposed to be under the control of the Palestinian Authority but is subject to frequent Israeli military incursions, Area B which is under joint Israeli-Palestinian control, and Area C, which is under sole Israeli control. This interim period ended in May 1999.

- For more information, see “Trading Away Peace: How Europe helps sustain illegal Israeli settlements.”

- Direct costs are the extra costs borne by Palestinians as a result of Israeli movement and access restrictions, including the higher costs of water and electricity. Indirect costs are the foregone revenues from production that Palestinians would have made if there were no Israeli restrictions. An example of indirect cost is the value added from the extraction of Dead Sea resources.

- According to the PCBS labor force survey of November 2015, in July-September 2015 the number of Palestinian workers in Israeli settlements in the West Bank was 22,100 out of the 674,900 number of Palestinian workers in the West Bank.

- Compare this with the EU’s trade with the OPT, which was around 154 million Euros in 2014 (about $186 million.)

Samia Al-Botmeh is an assistant professor in economics at the Faculty of Business and Economics/ Birzeit University. She was the director for the Centre for Development Studies at Birzeit University till 2014. She worked with the Palestine Economic Policy Research Institute (MAS) in Ramallah as a researcher. She completed her PhD at the School of African and Oriental Studies- University of London, in labour economics. Areas of interest and publications are gender economics, labour economics, and political economy of development. She has engaged in research on alternatives to neo-liberal development in the West Bank and Gaza Strip, and gender differentials in labour market outcomes.

Al-Shabaka policy analyst, Leila Farsakh, is Associate Professor and Chair of the political science department at the University of Massachusetts Boston. She is the author of Palestinian Labor Migration to Israel: Labour, Land and Occupation (Routledge, 2012), and of Rethinking Statehood in Palestine: Self-determination beyond Partition (California University Press, 2022). She has worked with a number of organizations, including the Organization for Economic Cooperation and Development (OECD) in Paris and MAS in Ramallah, and she has been a senior research fellow at Birzeit University since 2008. In 2001, she won the Peace and Justice Award from the Cambridge Peace Commission.